NFT is a digital asset like Cryptocurrency. For NFT now digital artists can make more money than previous. In this article, I Explain what is NFT. Advantages, and Disadvantages of NFT, and How I can Invest or sell.

What is NFT?| Is it Crypto or not

NFT stands for Non-fungible token. The NFTs have revolutionized the concept of Digital Art. This Token is a digital asset like bitcoin. Now, this is the most profitable Art business. Every NFT is Certified on a Digital Diary known as Blockchain. non-fungible token focuses mainly on establishing ownership the digital art. NFT can be your Digital painting, song, image, video, etc.

The Craze for NFT started in 2017 due to a game called Cryptokitties. This is the game where players can buy, Breed, and sell Virtual cats. This is like your OLD WWE Tram Card but Virtual. In NFT Every artwork is unique, you can’t replace that with anything.

Market of NFT

popular NFT Artist Beeple, Who recently sold his art collection for 69 Million dollars. Beeple, Said this is the new Evolution Chapter in the history of art. However, their art is the third-highest price paid to any living artist.

Now NFT is popular in India. Recently, Musical Artiest Nucleya launched a 12-sec clip as an NFT. In February 2021 Amrit pal sing sold two digital arts for 1.8 million Rupees. Recently Vignesh Sundaresan blockchain entrepreneur, buy an Art from NFT for 69 Million Dollars. India is the most potential market because there have many talented Artiest.

Read Also: What is Cryptocurrency: How it’s Work

Advantages of NFT:

- NFT can help A digital artist receive their due Credit.

- For NFT now the digital artist can Actually earn money for their work.

- Artists receive a Royalty for each time when their art is sold.

- Anyone can buy and sell with a profit.

Disadvantages of NFT:

- NFTs don’t have Clear Regulations in India. (we don’t properly know it’s legal or not)

- Many people believe that the NFT is yet a bubble. So it can bust.

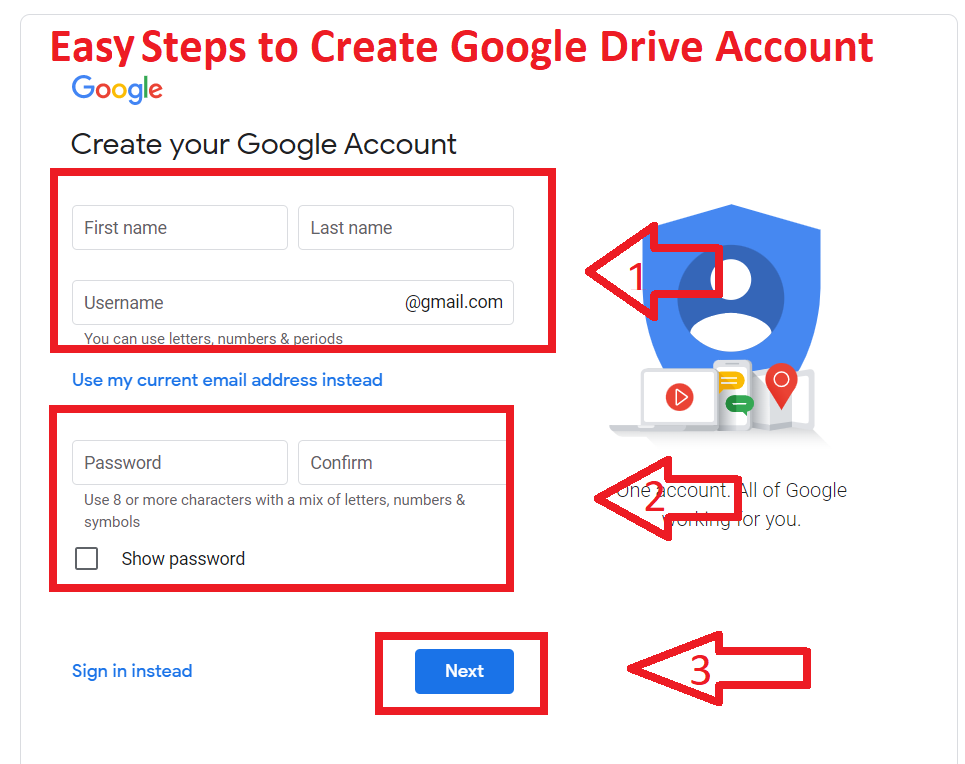

How I can invest or sell in NFT

You can buy NFT using third-party websites Like Opensea, Nonfungible.com, etc. Where you can buy the NFTS using your cryptocurrency known as Ethereum.Also, you can buy this using your Real currency. You can sell your NFTs to post your artwork on these websites.

For India have a Marketplace where you can buy or sell NFT. Which is called Wazirx NFT Marketplace.

I hope, you get the information about NFT. If you like this article, you can share and comment. So that we too have a chance to learn something from your ideas and improve something.

Read Also: