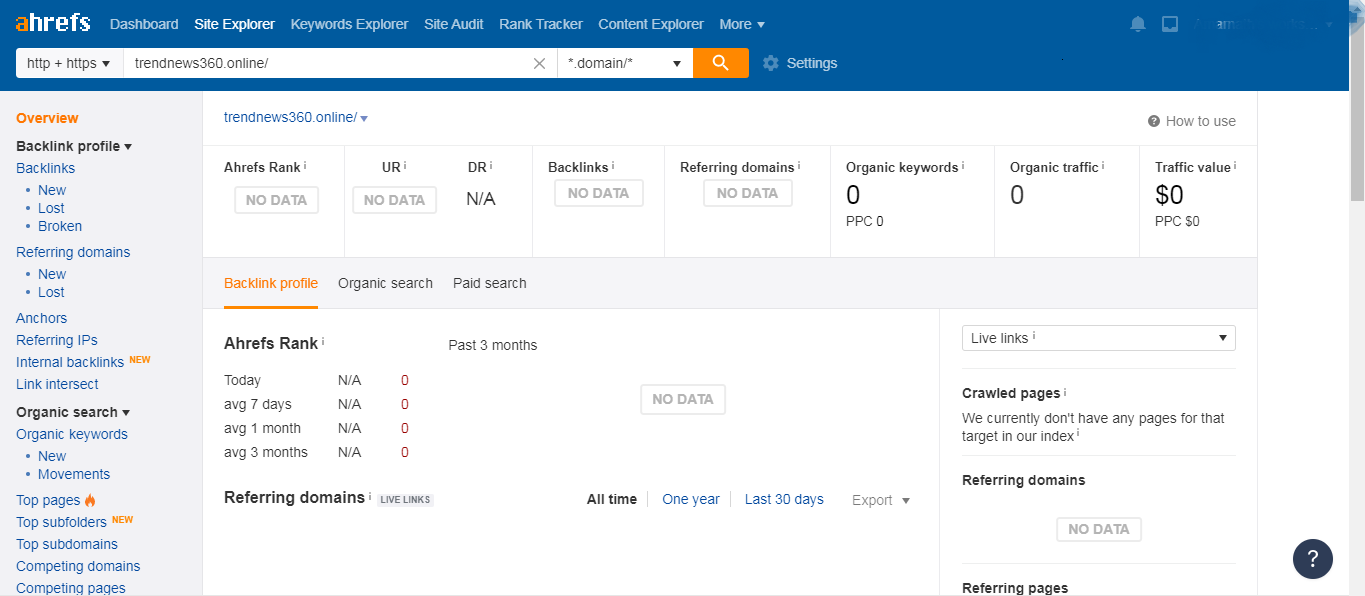

Ahref is the most popular analysis tool Which used for preparing audit reports, backlink analysis, URL rankings, competitive analysis, and many more. In this article, I explain Why doesn’t show my website status in ahrefs site explorer. Similarly, I give you suggestions on how to solve this.

Read Also: The advance trick to get AdSense approval in 2021

Why doesn’t show my website status in ahrefs site explorer:

Ahrefs have their own web crawler that examines millions of websites to retrieve information and store them in the Ahrefs database. if you create a new website like 1 week ago then you register your website in there you can see that type of problem No Data, No Result. Now ahrefs web-master tool is free for your own website usage.

Read Also: Best Hosting Services Provider in 2021

Suggestions(How to solve):

If your domain is new, please give the crawler some time to collect data from your website 2-3 weeks. after some time all information will appear in there also this depends on a page URL Rating and DA(Domain authority). I hope that helps you to understand If you see this kind of problem wait It will take time but it will solve very soon.

I hope you get the all information about Ahrefs Doesn’t Show My Website Status and how to solve it. If you like this article, you can share and comment. So that we too have a chance to learn something from your ideas and improve something.

Read Also:

- Top 5 Best Search Engine in 2021

- Explain What is NFT in Crypto?| How I can invest in NFT

- 20 Interesting Facts About Computer and Internet Technology.